Unlock Your Financial Freedom with Personal Loans in Des Moines, Iowa

Guide or Summary:Discover the Best Personal Loans Des Moines Iowa Has to OfferWhy Choose Personal Loans in Des Moines, Iowa?How to Apply for Personal Loans……

Guide or Summary:

- Discover the Best Personal Loans Des Moines Iowa Has to Offer

- Why Choose Personal Loans in Des Moines, Iowa?

- How to Apply for Personal Loans in Des Moines, Iowa

- Tips for Managing Your Personal Loan in Des Moines, Iowa

Discover the Best Personal Loans Des Moines Iowa Has to Offer

If you're residing in Des Moines, Iowa, and are in need of financial assistance, personal loans could be the perfect solution for you. Whether you're looking to consolidate debt, cover unexpected expenses, or fund a major purchase, understanding your options for personal loans Des Moines Iowa can help you make an informed decision.

Why Choose Personal Loans in Des Moines, Iowa?

Personal loans are versatile financial products that can be used for a variety of purposes. Unlike specific loans that are designated for particular purchases—like car loans or mortgages—personal loans give you the flexibility to use the funds as you see fit. This is particularly beneficial for residents of Des Moines who may face unique financial situations.

One of the key advantages of personal loans is that they often come with fixed interest rates, allowing you to budget effectively without worrying about fluctuating payments. Additionally, many lenders in Des Moines offer competitive rates and terms, making it easier for you to find a loan that fits your financial situation.

How to Apply for Personal Loans in Des Moines, Iowa

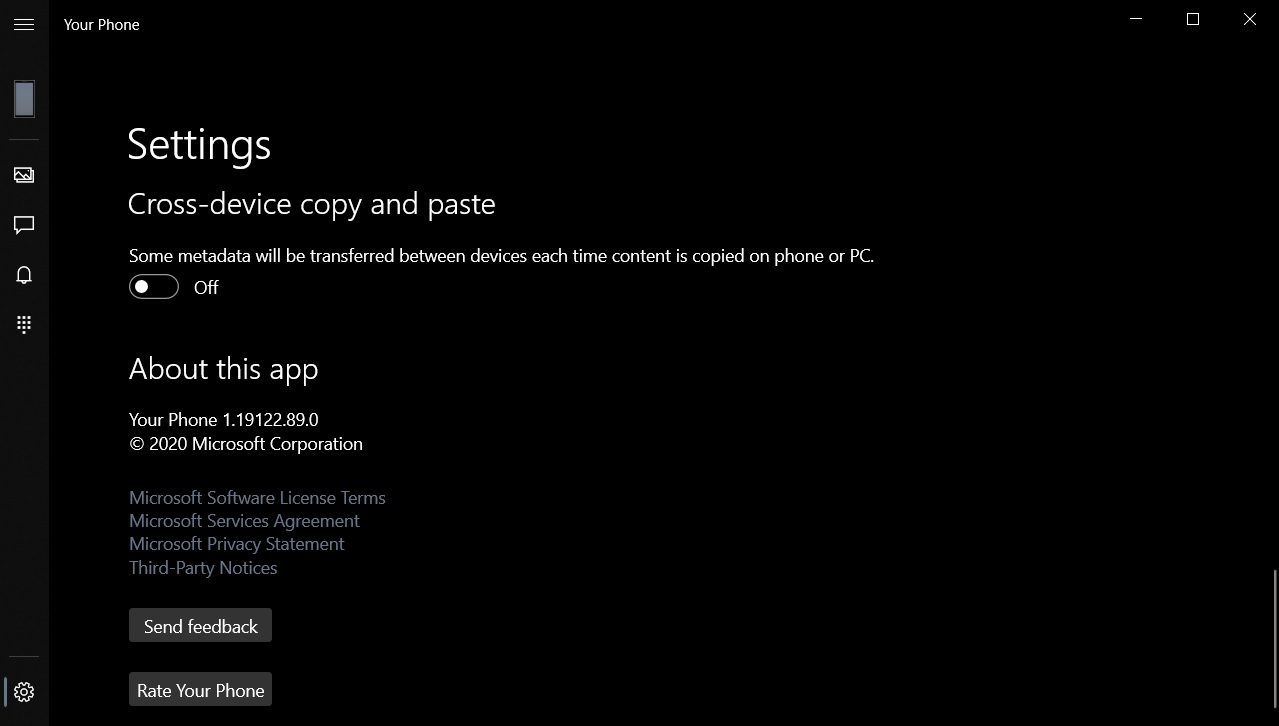

Applying for a personal loan in Des Moines is a straightforward process. Most lenders allow you to apply online, which means you can complete your application from the comfort of your home. Here’s a step-by-step guide to help you navigate the application process:

1. **Check Your Credit Score**: Before applying, it's essential to know your credit score. This will give you an idea of what interest rates you may qualify for and help you identify any areas for improvement.

2. **Research Lenders**: Not all lenders are created equal. Take the time to compare rates, terms, and customer reviews. Local credit unions and banks may offer better rates than larger national lenders.

3. **Gather Documentation**: Be prepared to provide documentation such as proof of income, employment verification, and details about your existing debts. This will help streamline the loan approval process.

4. **Submit Your Application**: Once you've selected a lender, complete the application. Be honest and thorough in your responses to avoid any delays.

5. **Review Loan Offers**: After submitting your application, you'll receive loan offers from lenders. Take the time to review each one carefully, focusing on the interest rate, repayment terms, and any fees associated with the loan.

6. **Accept the Loan**: Once you've found the right loan for your needs, accept the offer and finalize the paperwork. Most lenders will disburse the funds quickly, allowing you to access your money when you need it most.

Tips for Managing Your Personal Loan in Des Moines, Iowa

Once you've secured a personal loan, managing it effectively is crucial to maintaining your financial health. Here are some tips to help you stay on track:

- **Create a Budget**: Outline your monthly expenses and include your loan payments. This will help you allocate funds appropriately and avoid missing payments.

- **Set Up Automatic Payments**: Many lenders offer the option to set up automatic payments. This can help ensure that you never miss a due date, which can positively impact your credit score.

- **Communicate with Your Lender**: If you find yourself struggling to make payments, don’t hesitate to reach out to your lender. Many are willing to work with you to create a more manageable repayment plan.

In conclusion, if you're considering personal loans Des Moines Iowa, take the time to educate yourself about your options. With careful planning and responsible management, personal loans can be a powerful tool for achieving your financial goals. Whether you're looking to consolidate debt, finance a home improvement project, or cover unexpected expenses, the right personal loan can help you unlock your financial freedom.