# Unlocking Your Future: A Comprehensive Guide to Missouri Student Loans

## Introduction to Missouri Student LoansNavigating the world of higher education can be daunting, especially when it comes to financing your studies. For s……

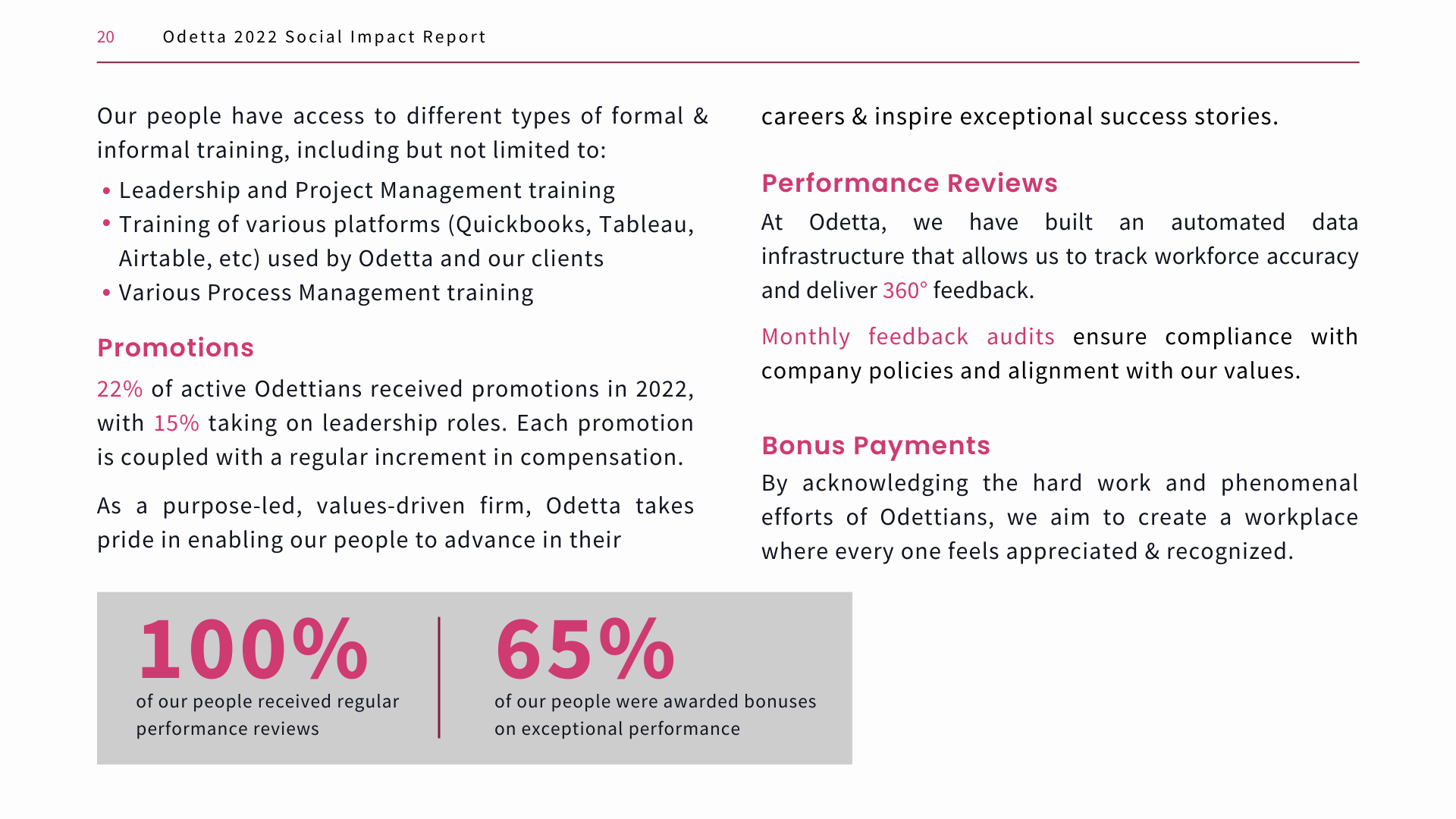

## Introduction to Missouri Student Loans

Navigating the world of higher education can be daunting, especially when it comes to financing your studies. For students in Missouri, understanding the various options available for student loans is crucial. This guide aims to provide you with an in-depth look at Missouri student loans, helping you make informed decisions that will set you on the path to success.

## Types of Missouri Student Loans

When considering Missouri student loans, it’s essential to know the different types available. Primarily, these loans fall into two categories: federal and private loans.

### Federal Student Loans

Federal student loans are funded by the government and offer several benefits, such as fixed interest rates and flexible repayment options. In Missouri, students may qualify for:

- **Direct Subsidized Loans**: These are need-based loans where the government pays the interest while you’re in school.

- **Direct Unsubsidized Loans**: Available to all students, these loans accrue interest while you’re in school, but you can choose to defer payments until after graduation.

- **Direct PLUS Loans**: Designed for graduate students and parents of dependent undergraduate students, these loans cover the remaining cost of education after other financial aid has been applied.

### Private Student Loans

Private student loans come from banks, credit unions, and other financial institutions. They often have variable interest rates and may require a credit check. While they can help bridge the gap between federal aid and the total cost of education, it’s crucial to thoroughly research terms and conditions before committing.

## How to Apply for Missouri Student Loans

The application process for Missouri student loans typically begins with the Free Application for Federal Student Aid (FAFSA). Completing the FAFSA is essential, as it determines your eligibility for federal loans and grants. Here’s a step-by-step guide:

1. **Gather Necessary Documents**: Collect your Social Security number, tax returns, and other financial documents.

2. **Visit the FAFSA Website**: Go to the official FAFSA website and create an account.

3. **Fill Out the Application**: Provide accurate information about your finances and your school.

4. **Submit Your FAFSA**: Ensure you submit your application before the deadline to maximize your eligibility for aid.

5. **Review Your Student Aid Report (SAR)**: After processing, you’ll receive a SAR detailing your financial aid eligibility.

## Repayment Options for Missouri Student Loans

Understanding repayment options is critical for managing your student loans effectively. Missouri offers various repayment plans, including:

- **Standard Repayment Plan**: Fixed monthly payments over ten years.

- **Graduated Repayment Plan**: Payments start lower and increase every two years.

- **Income-Driven Repayment Plans**: Payments are based on your income and family size, making them more manageable.

## Tips for Managing Your Missouri Student Loans

Successfully managing your Missouri student loans is vital for your financial future. Here are some tips to help you navigate your repayment journey:

1. **Stay Informed**: Regularly check your loan balance and interest rates.

2. **Create a Budget**: Allocate funds for loan payments to avoid falling behind.

3. **Consider Refinancing**: If you have good credit, refinancing may lower your interest rates and monthly payments.

4. **Explore Forgiveness Programs**: Investigate options like Public Service Loan Forgiveness if you work in qualifying fields.

## Conclusion

Missouri student loans can be a powerful tool in achieving your educational goals. By understanding the types of loans available, the application process, and repayment options, you can make informed decisions that will benefit your financial future. Remember, the key to successful loan management lies in staying organized and proactive. With the right approach, you can unlock the doors to your future without being overwhelmed by debt.