Can a Home Equity Loan Be Refinanced? Unlocking Financial Opportunities

Guide or Summary:Understanding Home Equity LoansThe Benefits of RefinancingThe Process of RefinancingWhen considering financial strategies, many homeowners……

Guide or Summary:

When considering financial strategies, many homeowners ponder the question: Can a home equity loan be refinanced? This inquiry opens the door to a world of possibilities, allowing you to leverage your home's equity for better financial outcomes. Refinancing a home equity loan can be a game-changer, offering lower interest rates, more favorable terms, or even a chance to consolidate debt. In this article, we will explore the nuances of refinancing a home equity loan, the benefits it can provide, and the steps involved in the process.

Understanding Home Equity Loans

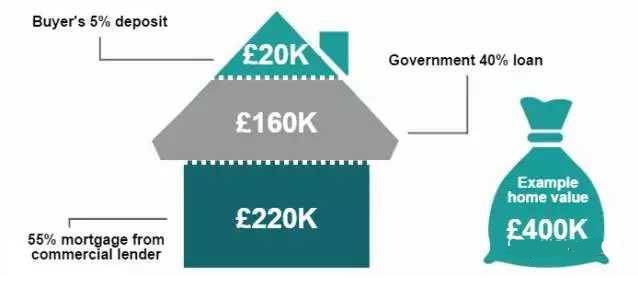

Before diving into the refinancing aspect, it's essential to understand what a home equity loan is. Essentially, a home equity loan allows homeowners to borrow against the equity they have built up in their property. This type of loan typically comes with a fixed interest rate and is disbursed as a lump sum, making it an attractive option for those looking to finance major expenses, such as home renovations or educational costs.

The Benefits of Refinancing

So, can a home equity loan be refinanced? Absolutely! Refinancing your home equity loan can provide several advantages:

1. **Lower Interest Rates**: If market conditions have changed since you first took out your loan, you might qualify for a lower interest rate, which can lead to substantial savings over time.

2. **Improved Loan Terms**: Refinancing can also allow you to adjust the terms of your loan. For instance, you might switch from a 15-year to a 30-year loan, reducing your monthly payments.

3. **Debt Consolidation**: If you have high-interest debt, refinancing your home equity loan can provide the funds needed to pay off those debts, simplifying your finances and potentially lowering your overall interest payments.

4. **Access to Additional Funds**: If your home's value has increased, refinancing can give you access to additional equity, providing you with extra cash for investments or major purchases.

The Process of Refinancing

If you're considering refinancing your home equity loan, here are the steps you should follow:

1. **Evaluate Your Current Loan**: Start by assessing your existing home equity loan. Look at your interest rate, remaining balance, and loan terms to understand what you want to improve.

2. **Check Your Credit Score**: A higher credit score can help you secure better refinancing options. If your score has improved since you first took out your loan, you may qualify for better rates.

3. **Research Lenders**: Not all lenders offer the same terms. Shop around and compare rates, fees, and customer reviews to find the best refinancing option for your needs.

4. **Prepare Documentation**: Lenders will require documentation such as income verification, tax returns, and information about your existing loan. Ensure you have these ready to streamline the process.

5. **Apply for Refinancing**: Once you've chosen a lender, submit your application. They will review your financial information and determine your eligibility.

6. **Close the Loan**: If approved, you'll go through a closing process similar to your original mortgage. Review all terms and conditions carefully before signing.

In conclusion, the question can a home equity loan be refinanced? has a resounding yes as an answer. Refinancing your home equity loan can provide numerous financial benefits, from lower interest rates to improved loan terms. Whether you're looking to consolidate debt, access additional funds, or simply lower your monthly payments, refinancing could be the key to unlocking your financial potential. If you're considering this option, take the time to evaluate your situation, research your options, and consult with financial professionals to make the most informed decision. Your home is not just a place to live; it's a valuable asset that can work for you!