Quickbooks Loans: Streamlining Your Business Financing with a User-Friendly Solution

In the fast-paced world of entrepreneurship, securing the right financing is crucial for the growth and sustainability of any business. Traditional banking……

In the fast-paced world of entrepreneurship, securing the right financing is crucial for the growth and sustainability of any business. Traditional banking methods often come with complex procedures, lengthy wait times, and stringent requirements that can be daunting for small business owners. This is where Quickbooks loans come into play, offering a user-friendly and efficient alternative to traditional banking for small and medium-sized enterprises (SMEs).

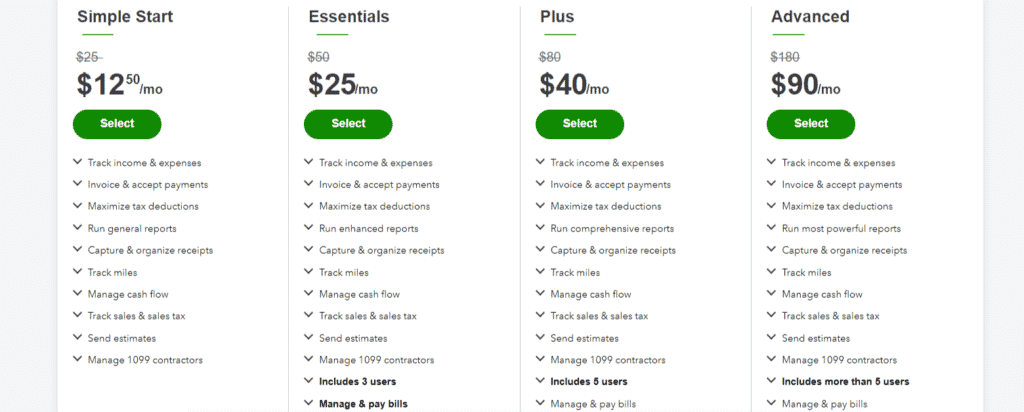

Quickbooks loans are designed to provide businesses with the necessary capital to fuel their growth without the hassle of navigating through the labyrinth of banking procedures. By leveraging the power of Quickbooks, a leading accounting software platform, these loans offer a seamless integration of financial management and business growth. With Quickbooks loans, businesses can access the capital they need to invest in new opportunities, expand their operations, or simply cover unexpected expenses, all while maintaining control over their financials.

One of the key advantages of Quickbooks loans is their accessibility. Unlike traditional bank loans, which may require a physical location or specific business criteria, Quickbooks loans can be accessed from anywhere, at any time. This flexibility allows businesses to quickly respond to market opportunities or changes, ensuring that they remain competitive in their industry.

Another significant benefit of Quickbooks loans is their simplicity. The application process is designed to be straightforward and user-friendly, eliminating the need for lengthy forms and extensive documentation. This not only saves time but also reduces the stress associated with securing financing. Once approved, Quickbooks loans can be disbursed quickly, allowing businesses to put the capital to work right away.

The integration of Quickbooks loans with the accounting software platform further enhances their value. By connecting the loan with Quickbooks, businesses can monitor their financial health in real-time, making informed decisions based on accurate and up-to-date financial data. This level of financial transparency is invaluable for businesses looking to optimize their operations and maximize their profitability.

Moreover, Quickbooks loans often come with favorable terms and conditions, including competitive interest rates and flexible repayment options. This makes it easier for businesses to manage their debt and allocate their resources effectively. The flexibility to choose the repayment period that best suits their cash flow needs ensures that businesses can continue to invest in their growth without being weighed down by debt.

In conclusion, Quickbooks loans represent a game-changer for small and medium-sized businesses looking to finance their growth. With their user-friendly application process, accessibility, simplicity, and seamless integration with Quickbooks, these loans offer a practical and efficient solution for businesses of all sizes. By leveraging Quickbooks loans, businesses can secure the capital they need to thrive, while maintaining control over their financials and optimizing their operations for long-term success. Whether you're looking to invest in new opportunities, expand your operations, or cover unexpected expenses, Quickbooks loans are a reliable and convenient financing option that can help your business reach new heights.