"The Ultimate Guide to Finding the Best Loan Website for Your Financial Needs"

Guide or Summary:Understanding Loan WebsitesTypes of Loans Available on Loan WebsitesBenefits of Using a Loan WebsiteHow to Choose the Right Loan WebsiteTip……

Guide or Summary:

- Understanding Loan Websites

- Types of Loans Available on Loan Websites

- Benefits of Using a Loan Website

- How to Choose the Right Loan Website

- Tips for Applying for a Loan Online

Understanding Loan Websites

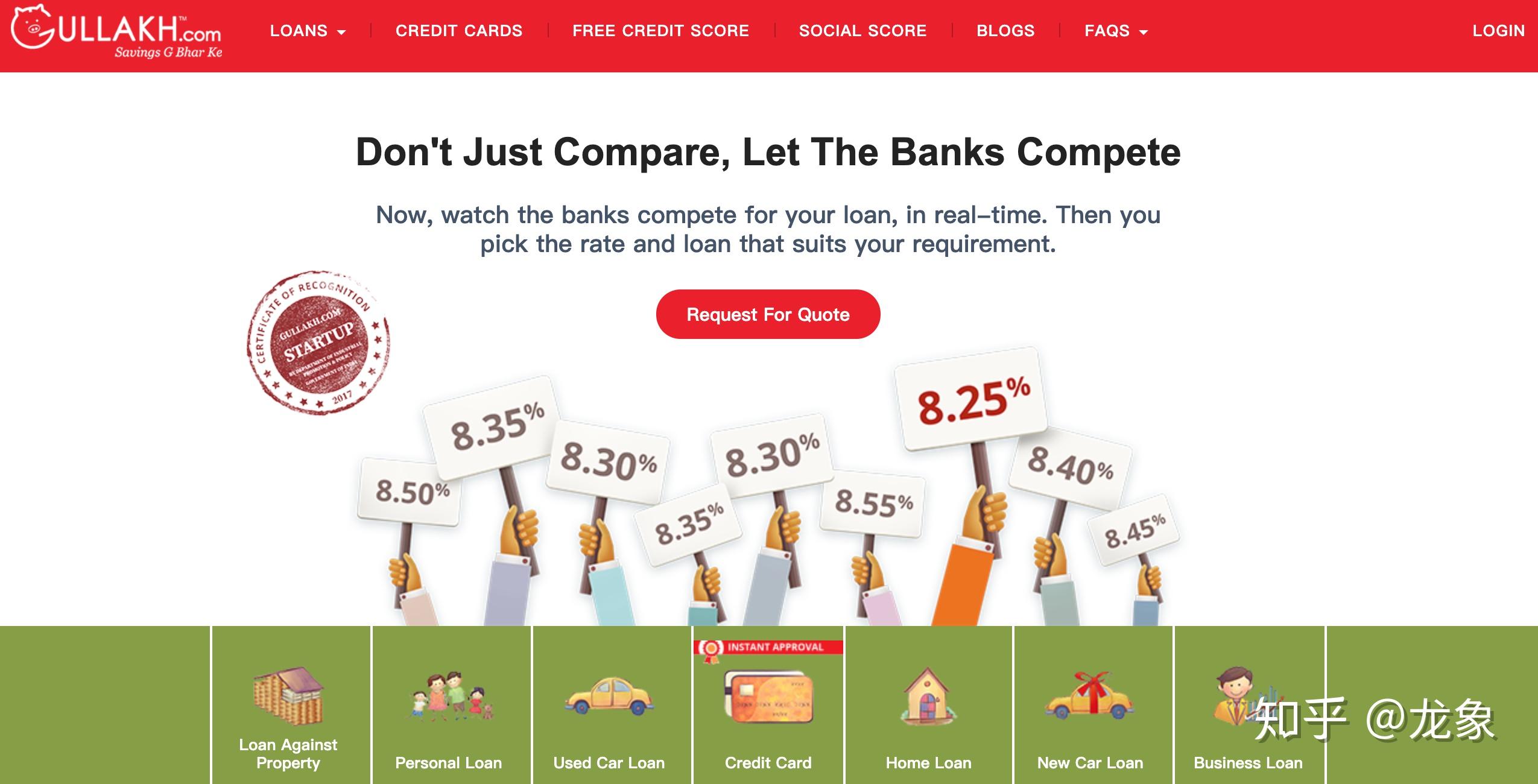

In today's digital age, the search for financial assistance has largely shifted online. A **loan website** serves as a platform where individuals can explore various loan options, compare rates, and apply for loans without the hassle of traditional banking. These websites have revolutionized the lending industry, making it easier for borrowers to access funds quickly and efficiently.

Types of Loans Available on Loan Websites

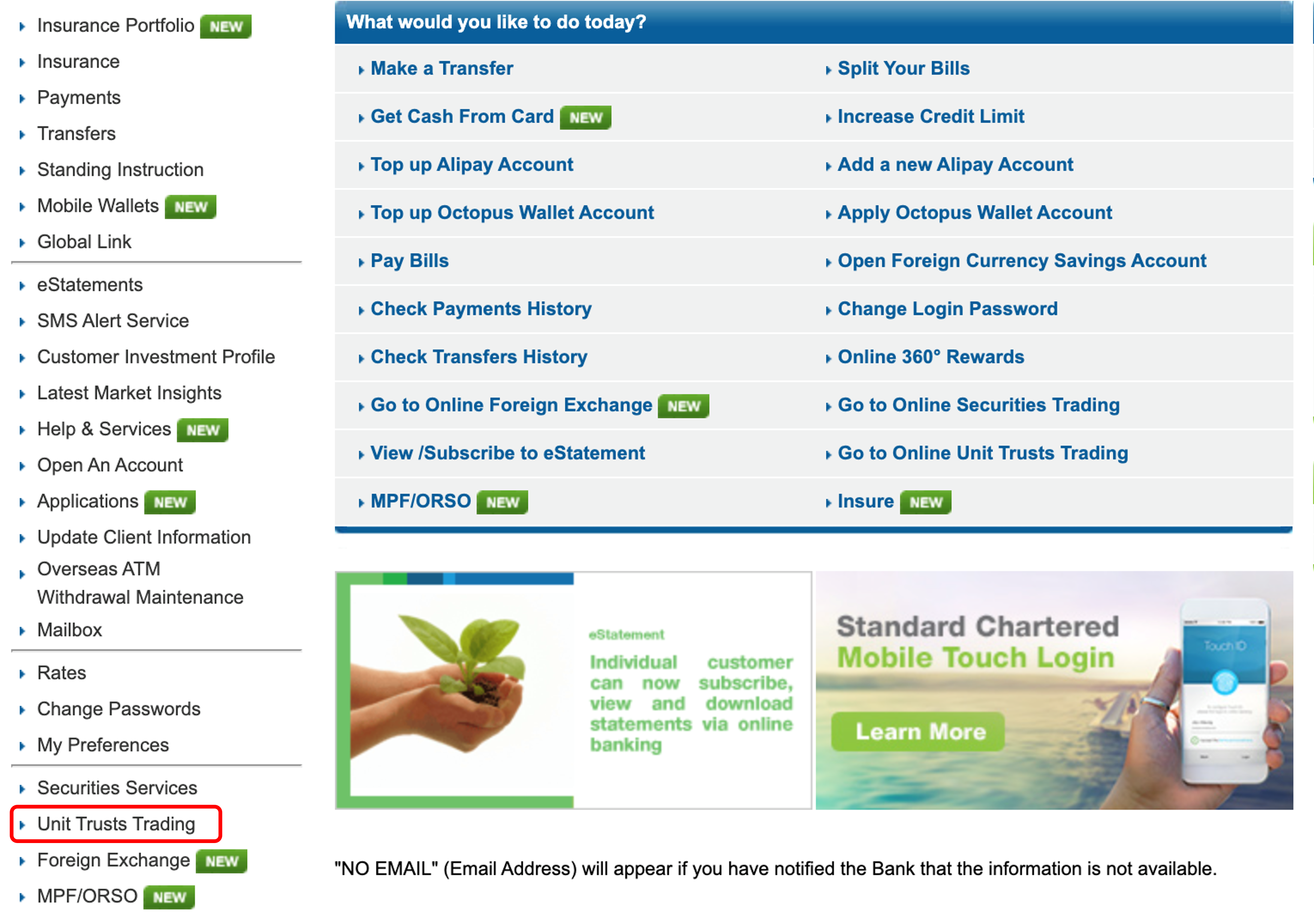

Loan websites typically offer a wide range of loan products, including personal loans, auto loans, home equity loans, and student loans. Each type of loan comes with its own set of terms, interest rates, and eligibility requirements. For instance, personal loans are often unsecured, meaning they don’t require collateral, while auto loans are secured by the vehicle being financed. Understanding the different types of loans available can help borrowers make informed decisions that align with their financial goals.

Benefits of Using a Loan Website

One of the primary benefits of using a **loan website** is the convenience it offers. Borrowers can compare multiple lenders and their offerings from the comfort of their own homes. This not only saves time but also allows individuals to find the best rates and terms available in the market. Additionally, many loan websites provide tools such as loan calculators, which can help users estimate their monthly payments and total interest costs, further aiding in their decision-making process.

How to Choose the Right Loan Website

When selecting a loan website, it’s important to consider a few key factors. First, look for websites that are reputable and have positive customer reviews. This can help ensure that you’re dealing with a trustworthy lender. Second, examine the variety of loan options available. A good loan website should offer a range of products to suit different financial needs. Finally, pay attention to the application process. A user-friendly interface and clear instructions can make the borrowing experience much smoother.

Tips for Applying for a Loan Online

Applying for a loan through a **loan website** can be a straightforward process, but there are several tips to keep in mind to increase your chances of approval. First, check your credit score before applying. A higher credit score can lead to better loan terms and interest rates. Second, gather all necessary documentation, such as proof of income, identification, and any other required information, to streamline the application process. Lastly, don’t hesitate to reach out to customer service if you have any questions or need assistance during the application.

In conclusion, a **loan website** can be an invaluable resource for individuals seeking financial assistance. By understanding the different types of loans available, the benefits of using these platforms, and how to choose the right one, borrowers can navigate the lending landscape with confidence. With careful research and preparation, finding the best loan options to meet your financial needs has never been easier. Whether you’re looking to consolidate debt, finance a major purchase, or cover unexpected expenses, the right loan website can help you achieve your financial goals.