Empowering Women: The Ultimate Guide to Securing a Loan for Women

#### Understanding Loans for WomenIn today's financial landscape, loans for women have become a vital resource for empowering female entrepreneurs and indiv……

#### Understanding Loans for Women

In today's financial landscape, loans for women have become a vital resource for empowering female entrepreneurs and individuals seeking financial independence. These loans are specifically designed to address the unique challenges women face in accessing credit and funding.

#### The Importance of Loans for Women

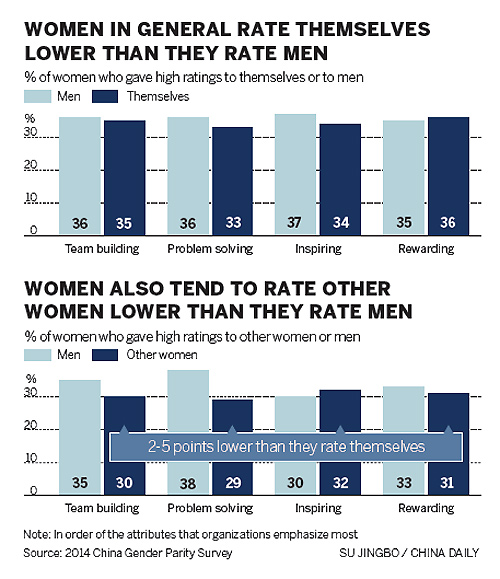

Women have historically faced barriers when it comes to obtaining loans and financial support. Discrimination, lower average incomes, and a lack of collateral can make it difficult for women to secure the funding they need. However, loans for women are tailored to bridge this gap, providing opportunities for women to start businesses, pursue education, or manage personal expenses.

#### Types of Loans Available for Women

There are various types of loans available specifically for women. These include:

1. **Business Loans for Women**: Designed to help female entrepreneurs start or expand their businesses, these loans often come with lower interest rates and more flexible repayment terms.

2. **Personal Loans for Women**: These loans can help women manage personal expenses, such as medical bills, education costs, or home improvements.

3. **Microloans**: Small loans that are often provided to women in developing countries or low-income communities, aimed at empowering them to start small businesses.

4. **Grants for Women**: While not loans, grants provide financial assistance that does not require repayment, making them an attractive option for women seeking funding.

#### How to Apply for a Loan for Women

Applying for a loan for women involves several steps:

1. **Research**: Start by researching different lenders and the types of loans they offer. Look for organizations that specifically support women.

2. **Prepare Your Documentation**: Gather necessary documents, such as proof of income, credit history, and a business plan if applying for a business loan.

3. **Check Your Credit Score**: A good credit score can significantly increase your chances of approval. If your score is low, consider taking steps to improve it before applying.

4. **Submit Your Application**: Fill out the application form carefully, providing all required information accurately.

5. **Follow Up**: After submitting your application, follow up with the lender to check on the status of your loan.

#### Benefits of Loans for Women

The benefits of securing a loan for women are numerous:

- **Financial Independence**: Access to loans allows women to take control of their financial futures and make decisions that align with their goals.

- **Business Growth**: For female entrepreneurs, loans can provide the necessary capital to launch or expand a business, creating jobs and contributing to the economy.

- **Education Opportunities**: Loans can help women pursue higher education, leading to better job prospects and increased earning potential.

- **Support Networks**: Many organizations that offer loans for women also provide additional resources, such as mentorship programs and networking opportunities.

#### Conclusion

In conclusion, loans for women are an essential tool for promoting gender equality in the financial sector. By understanding the types of loans available, the application process, and the benefits they offer, women can better navigate their financial journeys. Whether you're looking to start a business, further your education, or manage personal expenses, exploring loan options tailored for women can help you achieve your goals and empower you to take charge of your financial future.