A Comprehensive Guide on How to Refinance a Home Equity Loan for Maximum Savings

#### How to Refinance a Home Equity LoanRefinancing a home equity loan can be a strategic financial move that allows homeowners to access better interest ra……

#### How to Refinance a Home Equity Loan

Refinancing a home equity loan can be a strategic financial move that allows homeowners to access better interest rates, reduce monthly payments, or consolidate debt. In this detailed guide, we will explore the essential steps, benefits, and considerations involved in the process of refinancing a home equity loan.

#### Understanding Home Equity Loans

Before diving into the refinancing process, it's crucial to understand what a home equity loan is. A home equity loan allows homeowners to borrow against the equity they have built up in their property. This type of loan is often used for significant expenses such as home renovations, education costs, or debt consolidation. However, as market conditions change, homeowners may find themselves in a position where refinancing becomes beneficial.

#### Why Refinance a Home Equity Loan?

There are several reasons why homeowners might consider refinancing their home equity loans:

1. **Lower Interest Rates**: If interest rates have decreased since you took out your original loan, refinancing can help you secure a lower rate, resulting in significant savings over time.

2. **Better Loan Terms**: Homeowners may want to switch from an adjustable-rate home equity loan to a fixed-rate loan for more predictable payments.

3. **Access More Equity**: If the value of your home has increased, refinancing can allow you to tap into more of your home’s equity.

4. **Debt Consolidation**: By refinancing, homeowners can consolidate higher-interest debts into a single loan with a lower interest rate.

5. **Improved Cash Flow**: Lowering monthly payments through refinancing can improve overall cash flow, providing more financial flexibility.

#### Steps to Refinance a Home Equity Loan

1. **Assess Your Financial Situation**: Before starting the refinancing process, evaluate your current financial status, including your credit score, income, and existing debt. A higher credit score can lead to better refinancing options.

2. **Research Lenders**: Shop around and compare different lenders to find the best refinancing options. Look for lenders that offer competitive rates and favorable terms.

3. **Gather Documentation**: Prepare necessary documents such as proof of income, tax returns, and information about your current mortgage and home equity loan.

4. **Apply for Refinancing**: Once you’ve chosen a lender, submit your application. Be prepared for the lender to conduct a credit check and assess your property’s value.

5. **Review Loan Estimates**: After your application is processed, you will receive loan estimates from the lender. Carefully review these documents to understand the terms, fees, and potential savings.

6. **Close the Loan**: If you’re satisfied with the terms, you can proceed to close the loan. This process may involve paying closing costs, so ensure you understand all associated fees.

7. **Manage Your New Loan**: After refinancing, keep track of your payments and manage your loan responsibly to maintain good credit and financial health.

#### Considerations Before Refinancing

While refinancing a home equity loan can provide many benefits, it’s essential to consider the following:

- **Closing Costs**: Refinancing often comes with closing costs that can add up. Ensure that the savings from refinancing outweigh these costs.

- **Loan Terms**: Be mindful of the loan terms. Extending the loan term may reduce monthly payments but can increase the total interest paid over the life of the loan.

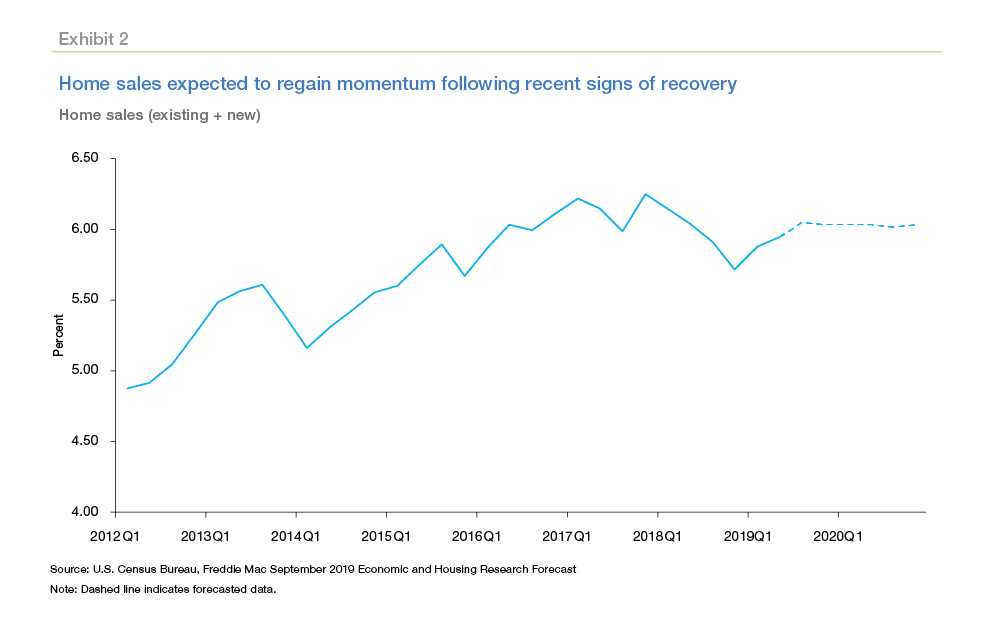

- **Market Conditions**: Keep an eye on market trends. Timing your refinance can significantly impact the interest rates you receive.

- **Impact on Credit Score**: Applying for a new loan can temporarily affect your credit score. Be sure to weigh this factor against your financial goals.

In conclusion, refinancing a home equity loan can be a powerful tool for homeowners looking to optimize their financial situation. By understanding the process and carefully evaluating your options, you can make informed decisions that lead to long-term savings and improved financial health.