Unlocking Opportunities: A Comprehensive Guide to 2nd Home Loan Mortgage

#### Understanding 2nd Home Loan MortgageA **2nd home loan mortgage** refers to a type of financing that allows individuals to purchase a second property, w……

#### Understanding 2nd Home Loan Mortgage

A **2nd home loan mortgage** refers to a type of financing that allows individuals to purchase a second property, which is not their primary residence. This can include vacation homes, rental properties, or even investment properties. Understanding the intricacies of this financial product is crucial for potential buyers looking to expand their real estate portfolio.

#### Benefits of a 2nd Home Loan Mortgage

Investing in a second home can offer numerous advantages. Firstly, it provides an opportunity for rental income. If the second property is located in a desirable area, homeowners can rent it out when not in use, generating additional cash flow. Secondly, a second home can serve as a vacation retreat, allowing families to create lasting memories without the hassle of booking hotels. Moreover, property values tend to appreciate over time, making a second home a potential long-term investment.

#### Eligibility Criteria for 2nd Home Loan Mortgage

Before applying for a **2nd home loan mortgage**, it's essential to understand the eligibility criteria. Lenders typically look for a good credit score, a stable income, and a low debt-to-income ratio. Additionally, borrowers should have sufficient equity in their primary residence and a down payment ready, which is usually higher than that for a primary home. It's advisable to check with multiple lenders to find the best terms and rates.

#### Types of 2nd Home Loan Mortgages

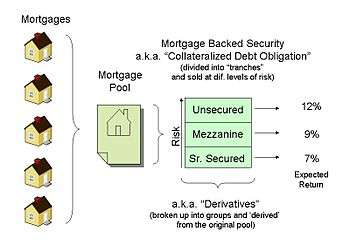

There are various types of mortgages available for purchasing a second home. Fixed-rate mortgages provide stability with consistent monthly payments, while adjustable-rate mortgages (ARMs) offer lower initial rates that can increase over time. Another option is a home equity line of credit (HELOC), which allows homeowners to borrow against the equity in their primary residence to finance the purchase of a second home. Understanding these options can help buyers choose the right mortgage for their financial situation.

#### Steps to Secure a 2nd Home Loan Mortgage

Securing a **2nd home loan mortgage** involves several steps. First, potential buyers should assess their financial situation and determine how much they can afford. Next, they should gather necessary documentation, including tax returns, pay stubs, and bank statements, to present to lenders. After that, it's time to shop around for the best mortgage rates and terms. Once a lender is chosen, buyers can submit their application and await approval. Finally, a home inspection and appraisal will be conducted before closing the deal.

#### Potential Challenges of a 2nd Home Loan Mortgage

While there are many benefits to obtaining a **2nd home loan mortgage**, it's essential to be aware of potential challenges. Market fluctuations can affect property values, and maintaining a second home can incur additional costs such as property taxes, insurance, and maintenance. Furthermore, if the property is not rented out, homeowners may face financial strain. It's crucial to conduct thorough research and consider these factors before making a decision.

#### Conclusion: Making the Right Choice

In conclusion, a **2nd home loan mortgage** can be a valuable tool for those looking to invest in real estate or enjoy a second property. By understanding the benefits, eligibility criteria, types of mortgages available, and the steps involved in securing a loan, potential buyers can make informed decisions. While there are challenges associated with owning a second home, the rewards can be significant, making it a worthwhile consideration for many. Always consult with financial advisors and real estate professionals to ensure the best outcomes.