Unlocking the Secrets to the Best Home Loan Mortgage Rates: Your Ultimate Guide

#### Best Home Loan Mortgage RatesWhen it comes to purchasing a home, one of the most critical factors to consider is the mortgage rate. The **best home loa……

#### Best Home Loan Mortgage Rates

When it comes to purchasing a home, one of the most critical factors to consider is the mortgage rate. The **best home loan mortgage rates** can significantly impact your monthly payments and the total cost of your home over time. Understanding how to find and secure these rates is essential for any prospective homeowner.

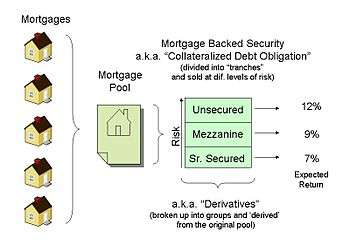

#### Understanding Mortgage Rates

Mortgage rates are influenced by several factors, including the economy, inflation, and the Federal Reserve's interest rate policies. These rates can fluctuate daily, making it essential for homebuyers to stay informed and act quickly when they find a favorable rate. The **best home loan mortgage rates** are typically offered to borrowers with excellent credit scores, stable incomes, and a significant down payment.

#### Types of Mortgage Rates

There are two primary types of mortgage rates: fixed and adjustable. Fixed-rate mortgages maintain the same interest rate throughout the life of the loan, providing stability and predictability in monthly payments. On the other hand, adjustable-rate mortgages (ARMs) start with a lower initial rate that can change after a specified period, which could result in lower payments initially but may increase over time.

#### Factors Affecting Mortgage Rates

1. **Credit Score**: Lenders use your credit score to assess your risk as a borrower. A higher credit score generally qualifies you for the **best home loan mortgage rates**.

2. **Down Payment**: The size of your down payment can also influence your mortgage rate. A larger down payment reduces the lender's risk and may result in a lower rate.

3. **Loan Term**: The length of your mortgage can affect your rate. Shorter-term loans often come with lower interest rates compared to longer-term loans.

4. **Market Conditions**: Economic conditions, including inflation and employment rates, can impact mortgage rates. Keeping an eye on these factors can help you time your purchase for the best rates.

#### How to Find the Best Home Loan Mortgage Rates

1. **Shop Around**: Don’t settle for the first offer you receive. Compare rates from multiple lenders, including banks, credit unions, and online mortgage companies.

2. **Improve Your Credit Score**: Before applying for a mortgage, check your credit report and take steps to improve your score if necessary. Pay off debts, make payments on time, and avoid new credit inquiries.

3. **Consider Different Loan Types**: Explore various loan products to find the one that offers the **best home loan mortgage rates** for your financial situation.

4. **Get Pre-Approved**: Getting pre-approved for a mortgage can give you a better idea of what rates you qualify for and strengthen your position when making an offer on a home.

5. **Lock in Your Rate**: Once you find a favorable rate, consider locking it in with your lender. Rate locks can protect you from potential increases while you finalize your home purchase.

#### Conclusion

Securing the **best home loan mortgage rates** is a crucial step in the home-buying process. By understanding how mortgage rates work, what factors influence them, and how to find the best deals, you can save thousands of dollars over the life of your loan. Remember to stay informed, compare offers, and take proactive steps to improve your financial profile. With the right preparation, you can achieve your dream of homeownership at an affordable cost.