Unlocking Opportunities: Understanding Rural Housing Loans for Your Dream Home

Guide or Summary:Rural Housing Loans are specialized financial products designed to assist individuals and families in purchasing homes in rural areas. Thes……

Guide or Summary:

Rural Housing Loans are specialized financial products designed to assist individuals and families in purchasing homes in rural areas. These loans are often backed by government programs aimed at promoting homeownership in less populated regions, making it easier for residents to secure financing for their dream homes.

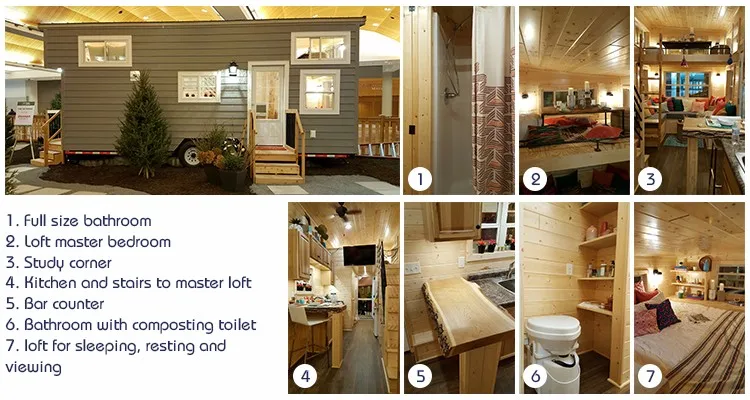

In recent years, the demand for Rural Housing Loans has surged, as more people seek to escape the hustle and bustle of urban life and find tranquility in the countryside. With the rise of remote work and an increasing desire for spacious living, rural areas have become attractive destinations for homebuyers. However, navigating the world of Rural Housing Loans can be daunting for many. This article aims to demystify the process and provide valuable insights into how these loans work, eligibility requirements, and the benefits they offer.

### Understanding the Basics of Rural Housing Loans

At its core, a Rural Housing Loan is a type of mortgage specifically designed for properties located in designated rural areas. The most well-known program in the United States is the USDA Rural Development Guaranteed Housing Loan Program, which offers 100% financing with no down payment required for eligible borrowers. This makes homeownership more accessible to individuals who might not have significant savings for a down payment.

### Key Benefits of Rural Housing Loans

1. **No Down Payment**: One of the most significant advantages of Rural Housing Loans is the ability to purchase a home without a down payment. This feature is particularly beneficial for first-time homebuyers or those with limited financial resources.

2. **Lower Interest Rates**: Generally, Rural Housing Loans offer competitive interest rates compared to conventional loans. This can lead to substantial savings over the life of the loan, making monthly payments more manageable.

3. **Flexible Credit Requirements**: Many lenders offering Rural Housing Loans are more lenient regarding credit scores. This inclusivity allows individuals with less-than-perfect credit histories to qualify for a mortgage.

4. **Support for Low-Income Families**: The USDA program specifically targets low to moderate-income families, ensuring that those who need assistance the most can access affordable housing options in rural areas.

5. **Community Development**: By encouraging homeownership in rural areas, Rural Housing Loans contribute to the overall development and revitalization of these communities. Homeownership can lead to increased property values and a stronger local economy.

### Eligibility Requirements for Rural Housing Loans

To qualify for a Rural Housing Loan, borrowers must meet specific criteria set by the lending institution and the USDA. These typically include:

- **Location**: The property must be located in a designated rural area, as defined by the USDA.

- **Income Limits**: Borrowers must have a household income that does not exceed 115% of the median income for the area.

- **Creditworthiness**: While the credit requirements are more flexible, borrowers should ideally have a credit score of at least 640.

- **Primary Residence**: The loan must be used to purchase a home that will serve as the borrower's primary residence.

### How to Apply for a Rural Housing Loan

The application process for a Rural Housing Loan is similar to that of conventional mortgages. Potential borrowers should:

1. **Research Lenders**: Look for lenders who specialize in rural loans and compare their offerings.

2. **Gather Documentation**: Prepare necessary documents, including income verification, credit history, and employment details.

3. **Pre-Approval**: Seek pre-approval to understand how much you can afford and strengthen your position when making an offer on a home.

4. **Find a Home**: Work with a real estate agent familiar with rural properties to find a suitable home.

5. **Close the Loan**: Once you have an accepted offer, complete the loan application process and close on your new home.

### Conclusion

In summary, Rural Housing Loans present an excellent opportunity for individuals and families looking to achieve homeownership in rural areas. With benefits like no down payment, lower interest rates, and flexible credit requirements, these loans can pave the way for a brighter future in a peaceful setting. As the trend of moving to rural areas continues to grow, understanding and leveraging Rural Housing Loans will be essential for many aspiring homeowners.