"Maximize Your Project's Potential: A Comprehensive Guide to Using the Commercial Construction Loan Calculator"

#### Understanding Commercial Construction LoansCommercial construction loans are essential financial tools for businesses looking to build or renovate comm……

#### Understanding Commercial Construction Loans

Commercial construction loans are essential financial tools for businesses looking to build or renovate commercial properties. These loans are typically short-term and are used to cover the costs associated with construction, including materials, labor, and other related expenses. Understanding how these loans work is crucial for any business owner or investor looking to undertake a construction project.

#### The Importance of a Commercial Construction Loan Calculator

A commercial construction loan calculator is an invaluable resource for estimating the costs and potential financing options for your construction project. This tool allows users to input various parameters, such as the total project cost, loan term, interest rate, and down payment, to generate an estimate of monthly payments and total interest paid over the life of the loan. By utilizing this calculator, you can gain a clearer picture of your financial obligations and make informed decisions about your project.

#### How to Use a Commercial Construction Loan Calculator

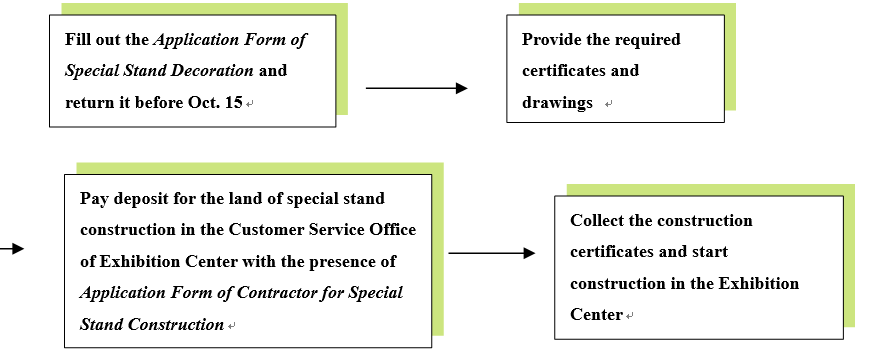

Using a commercial construction loan calculator is straightforward. Here’s a step-by-step guide on how to effectively use this tool:

1. **Input Project Cost**: Begin by entering the total estimated cost of your construction project. This figure should encompass all expenses, including materials, labor, permits, and any other associated costs.

2. **Enter Loan Details**: Next, input the loan amount you plan to borrow. This is typically a percentage of the total project cost, depending on the lender’s requirements.

3. **Set the Interest Rate**: Enter the interest rate offered by your lender. This rate can vary based on your creditworthiness, the lender’s policies, and current market conditions.

4. **Determine Loan Term**: Specify the duration of the loan, usually expressed in months or years. Shorter loan terms may result in higher monthly payments but less interest paid over time.

5. **Calculate**: After entering all necessary details, hit the calculate button. The calculator will provide you with an estimated monthly payment, total interest paid, and the overall cost of the loan.

#### Benefits of Using a Commercial Construction Loan Calculator

1. **Financial Clarity**: By estimating your monthly payments and total costs, you can better understand your financial obligations and plan your budget accordingly.

2. **Comparison Shopping**: Different lenders may offer varying interest rates and terms. By using the calculator, you can easily compare different loan scenarios and find the best option for your needs.

3. **Informed Decision-Making**: With a clearer picture of your potential financial commitments, you can make more informed decisions about your project, including whether to proceed with construction or seek alternative financing options.

4. **Project Planning**: Understanding your financing can also help in planning your project timeline and cash flow, ensuring you have the necessary funds available when needed.

#### Conclusion

In conclusion, utilizing a commercial construction loan calculator is a critical step for anyone considering a commercial construction project. This tool not only aids in financial planning but also enhances your ability to make informed decisions regarding your investment. By understanding the intricacies of commercial construction loans and leveraging the power of a loan calculator, you can maximize your project’s potential and ensure a successful outcome. Whether you are a seasoned investor or a first-time builder, this tool is an essential part of your construction financing toolkit.